top of page

PROJECTS

21 Unit Apartment 2021

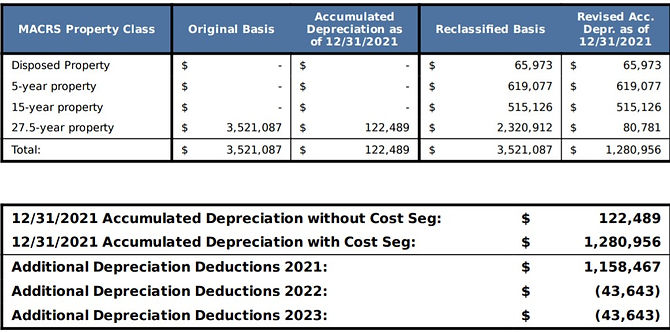

This 21 unit apartment complex in Beaverton, Oregon had an original basis (purchase price + renovation costs) of $3,521,087. Without a Cost Segregation study done the owner would have received $122,489 in depreciation deductions this year. After reclassifying the basis the accumulated depreciation works out to $1,280,956, a staggering $1.1million greater than without the study.

bottom of page